Likewise, it needs to debit the manufacturing overhead account as in the journal entry above. If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. Essentially, overapplied overhead means that a company has applied, or charged, less in overhead costs than it actually incurred.

Our mission is to improve educational access and learning for everyone.

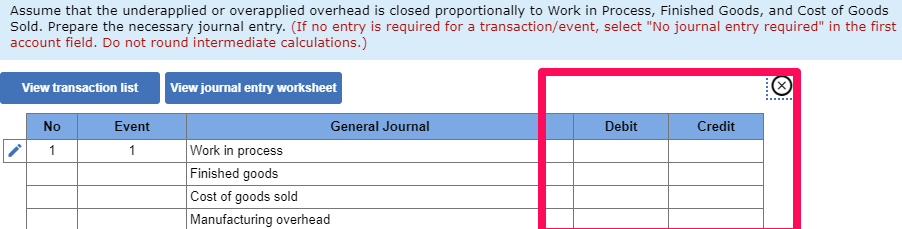

Instead, management needs to estimate the future overhead costs and allocate them throughout the production process. As noted above, underapplied overhead is reported on a company’s balance sheet as a prepaid expense or a short-term asset. In order to reconcile this, the company’s accounting department generally inputs a debit by the end of the year to the COGS section and a credit to the prepaid expenses section. Although those jobs are still inWork in Process or Finished Goods Inventory, companies usuallyadjust the Cost of Goods Sold account instead of each inventoryaccount. Adjusting each inventory account for a small overheadadjustment is usually not a good use of managerial and accountingtime and effort. All jobs appear in Cost of Goods Sold sooner orlater, so companies simply adjust Cost of Goods Sold instead of theinventory accounts.

Overapplied overhead example

- Advancements in electronic inventory and production management systems have greatly eased the burden of comprehensive operational reporting, often including underapplied overhead analysis.

- For another example, assuming the actual overhead cost that has occurred during the period is $11,000 instead while the applied overhead cost is $10,000, the same as the above example.

- On the other hand, the company can make the journal entry for underapplied overhead by debiting the cost of goods sold account and crediting the manufacturing overhead account.

- To do so, the company’s controller debits the manufacturing overhead cost pool for $15,000, while crediting the cost of goods sold account for the same amount.

- In this book, we assume companies transferoverhead balances to Cost of Goods Sold.

- Similarly, the work in process inventory account and finished goods inventory account will also be added in the overapplied overhead journal entry.

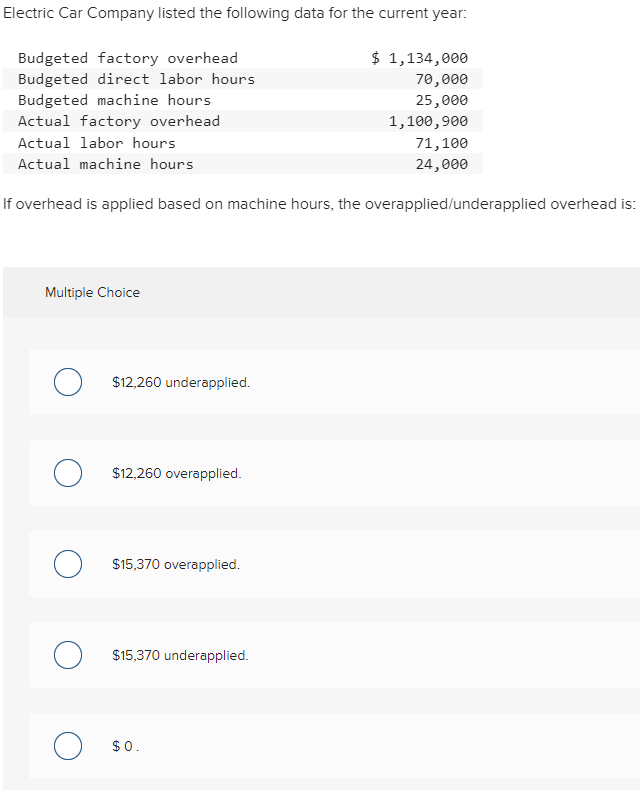

Thus, at year-end, the manufacturing overhead account often has a balance, indicating overhead was either overapplied or underapplied. This process is done by estimating a predetermined how to write a winning invoice letter in 8 easy steps overhead rate that can be used to split costs between jobs and departments. At the end of the period, the estimated costs and the actual costs incurred are compared.

Financial and Managerial Accounting

The opposite of overapplied overhead is underapplied overhead, which occurs when a company has applied more overhead to products than it has actually incurred. Similarly, the work in process inventory account and finished goods inventory account will also be added in the overapplied overhead journal entry. Learn effective strategies for managing overapplied overhead in cost accounting and its impact on financial statements. Over the long-term, the use of a standard overhead rate should result in some months in which overhead is overapplied, and some months in which it is underapplied.

This could involve decreasing the cost of goods sold, or adjusting other inventory accounts depending on the company’s accounting policy. This will ensure the company’s financial statements accurately reflect the actual overhead costs incurred during the period. As the manufacturing overhead costs that are applied to the production are based on the estimation, it rarely is equal to the actual overhead cost that really occurs during the period. In some cases, the overapplied overhead may also be allocated to work-in-process (WIP) inventory and finished goods inventory accounts, depending on where the overhead costs were initially applied. Adjusting entries in these accounts involve debiting the manufacturing overhead account and crediting the respective inventory accounts.

Regular variance analysis and monitoring are crucial for identifying and correcting both overapplied and underapplied overhead. By maintaining accurate overhead allocation, companies can improve their financial reporting and make more informed strategic decisions. Adjusting journal entries are necessary to correct the financial distortions caused by overapplied overhead. These entries ensure that the financial statements accurately reflect the company’s actual costs and financial position. The process begins by identifying the amount of overapplied overhead, which is the difference between the allocated overhead and the actual overhead incurred.

In financial terms, overapplied overhead results in a credit balance in the overhead account. This means that without the adjustment, the manufacturing overhead account will have a credit balance of $500 at the end of the period. Hence, we need to make the journal entry for the overapplied overhead of $500 by debiting that amount into the manufacturing overhead account to zero it out.

For example, the manufacturing company ABC finds that it has a $2,000 debit balance of the manufacturing overhead at the end of the accounting period. Understanding how to manage overapplied overhead ensures accurate financial reporting and helps maintain budgetary control within an organization. The machine shop estimates that its overhead will be $1,000 a month for next three months. After the quarter has ended, it turns out that total overhead incurred for the last three months was $3,600—not $3,000.

Companies use overhead analysis to determine their efficiency during a period of controlling overhead costs. Overapplied overhead occurs when the total amount of factory overhead costs assigned to produced units is more than was actually incurred in the period. This usually happens when a business uses a standard long-term overhead rate that is based on the average amount of factory overhead that is likely to be incurred, and the average number of units produced.

Advanced cost accounting software, such as QuickBooks and Microsoft Dynamics, can automate the tracking of overhead costs and provide real-time insights into cost variances. These tools enable companies to quickly identify and address discrepancies, reducing the likelihood of significant overapplied overhead at the end of the accounting period. Additionally, regular training and development for accounting staff can ensure that they are equipped with the latest knowledge and skills to manage overhead effectively.

Put simply, the business went over budget making the cost of goods sold more than expected. A journal entry must be made at the end of the period to reconcile the difference between the estimated amount and the actual overhead costs. In this case we would, debit the factory overhead account and credit the cost of goods sold account for the difference. Another strategy involves leveraging technology for real-time data analysis and monitoring.